Account for ultra-high-cost medicines

In addition to commonly prescribed drugs such as GLP-1s, another reason for the ongoing rise in spending is the growing presence of comparatively rare but ultra-expensive specialty medications entering the market. While the median launch price for a newly marketed drug was $2,115 in 2008, it had risen to $300,000 by 2023.

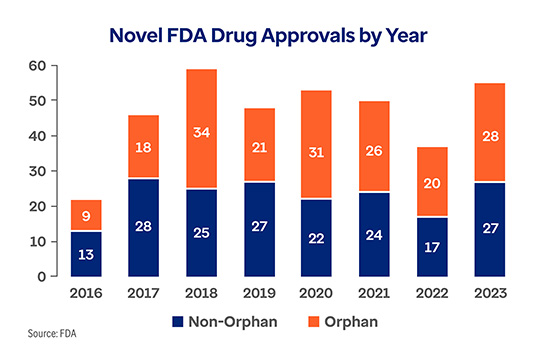

This trend looks to continue as drug manufacturers fill their development pipelines with increasingly expensive drugs. Orphan drugs, which are intended to treat rare conditions, are constituting a greater share of the pipeline. Despite being aimed at diseases with populations under 200,000 people, orphan drugs outpaced the number of new, non-orphan drugs approved annually by the FDA each of the last four years.

The Optum Rx Orphan Drug Program is a targeted strategy that leverages the clinical expertise of trained pharmacists to detect ineffective therapies and offer personalized clinical support for those members taking orphan drugs we’ve identified as having the greatest opportunity for clinical intervention and cost savings.

First developed for rare genetic diseases with very high unmet needs, gene therapies can have multi-million-dollar price tags and are in some ways the ultimate orphan drugs. Used to treat a rare form of hereditary blindness affecting between 1,000 and 2,000 people in the U.S, Luxturna® was the first gene therapy was approved by the FDA. Since then, a handful of other gene therapies have gained approval including a few therapies aimed at comparatively less rare conditions with larger potential populations including hemophilia and sickle cell disease. A recently approved gene therapy, Lenmeldy, has a wholesale cost of $4.25 million, making it the world's most expensive drug.

As more gene therapies enter the market, the chance that a plan sponsor will encounter a claim for one is only increasing. Our Gene Therapy Risk Protection solution uses a novel risk management approach to manage this risk. Instead of a one-time, multimillion dollar claim, plan sponsors can instead spread out the cost into a manageable, predictable per member per month (PMPM) fee.

Focus on member affordability

We know that patient affordability impacts access and adherence and ultimately overall medical costs. That’s why in addition to client-level solutions, Optum Rx is also taking on affordability challenges at the member level.

Furthering our commitment to lower out of pocket costs for members, the Optum Rx Critical Drug Affordability list helps lower or eliminate copays for members taking life-sustaining medications. There are now almost 300 medications that are part of the program. For example, in 2024 Optum Rx placed all preferred insulin products on tier one of standard commercial formularies, limiting out-of-pocket spend to $35 or less.

Another member-centric affordability solution is Optum Rx Price Edge. This free-to-use price transparency tool scans cash market pricing to deliver aggregate, real-time cost comparison between on-benefit member cost share and off-benefit pricing. When using Price Edge, members save an average $47 per non-covered prescription.*

Costing on average more than $84,000 annually, specialty medications present a true patient affordability challenge. Financial aid, whether through copay cards, foundation grants, manufacturer programs or alternative hardship programs, is often essential to helping patients afford them. Optum Savings IQTM technology proactively reviews the financial resources available for every Optum Specialty Pharmacy patient to help them pay for their medication. In 2023, Savings IQ helped connect members with $823.5M in financial aid assistance.*

Modern challenges require modern ideation. Optum Rx is committed to finding innovative ways to help keep the pharmacy benefit affordable and sustainable for plan sponsors and members today and in the years to come. Talk to your Optum Rx representative to learn more.