Insights (32)

Filter

-

IRS 2024 HSA contribution limits

The IRS announced an increase in HSA contribution limits for the 2024 tax year.

-

Transfer your HSA

Save time by combining your HSA funds into one account with Optum Financial.

-

HSA-FSA card: Pay the smarter way

Your card is the most convenient way to pay for qualified expenses. You also save an average of 30% since you're using pretax funds.

-

HSA Tax Center

Questions about your taxes? We're here to help. You can get copies of your most recent tax forms by signing in to your account.

-

Health savings account (HSA) webinars

Are you making the most of your HSA? Check out a live webinar offered by Optum Financial and get answers to your questions from an HSA expert.

-

Claims resource center

Claims can feel complicated. The process to get reimbursed doesn't have to be. Find answers and resources to simplify it below.

-

HSA and FSA cards

You just swipe, save, and skip the extra steps, plus, you save up to 30%* because you’re using pre-tax dollars.

-

Calculate your health savings

See how your health accounts can impact your wallet. Use our tools and resources to calculate how to save and pay for qualified expenses.

-

Health Savings Checkup tool

Estimate health care costs during retirement.

-

Optum Financial mobile app

Save time and take control with our advanced mobile app. Download the app today.

-

What is a dependent care FSA?

Learn how you can use tax-free money to pay for dependent care.

-

HSAs: Part of Your Financial Plan

Learn more about how your HSA can be part of your broader financial planning to create a savings nest egg and potentially save big on taxes.

-

HSAs and Medicare

Learn more about what happens to your HSA once you enroll in Medicare.

-

Add a beneficiary to your HSA or MSA

Take a minute to ensure you have a beneficiary selected.

-

Contribution limits

Max out your HSA this year with the contribution limit set by the IRS.

-

HSA withdrawal correction form

This form can be used to redeposit funds withdrawn in error and cannot be used to correct an Excess Contribution Return.

-

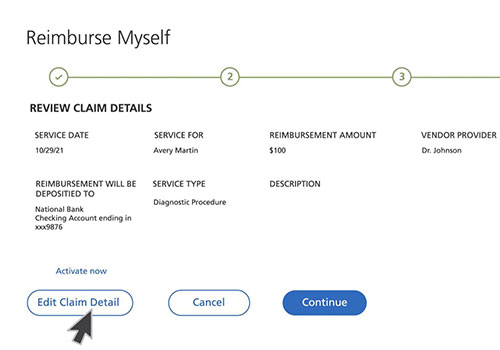

How to file a claim

Learn how to file a claim for an out-of-pocket expense using your flexible spending account (FSA). It’s easy.

-

HSA investment overview

Watch this video to learn more about how to set up your investment account — and start investing today.

-

Spending your FSA dollars

Learn more about how to manage your FSA funds so you don't lose them.

-

The five stages of your HSA journey

Learn more about the five-stage journey we go through as we save and pay for qualified medical expenses.

-

Options to Invest Your HSA

This video shows you the differences between your two investment options and how to get started.

-

How to upload a receipt

You made an eligible purchase with an Optum Financial payment card. Learn how to upload an itemized receipt or an explanation of benefits.

-

New account holder checklist

Make sure you're making the most of your new HSA with these easy steps.

-

Manage your HSA contributions

Are you taking full advantage of all your HSA's tax benefits by contributing the maximum each year?